Book Review: The Opposite of Spoiled

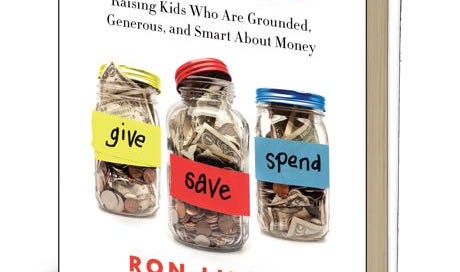

I feel kind of bad for my kids that I just read The Opposite of Spoiled. Have you guys heard about this book? It's written by Ron Lieber, New York Times personal finance columnist (and onetime DALS contributor, you may recall) and I fear it's going to be one of those books that informs every conversation I have with them, around the dinner table and oth…